1st Quarter of 2021 Financial Results.

1st Quarter of 2021 Financial Results.

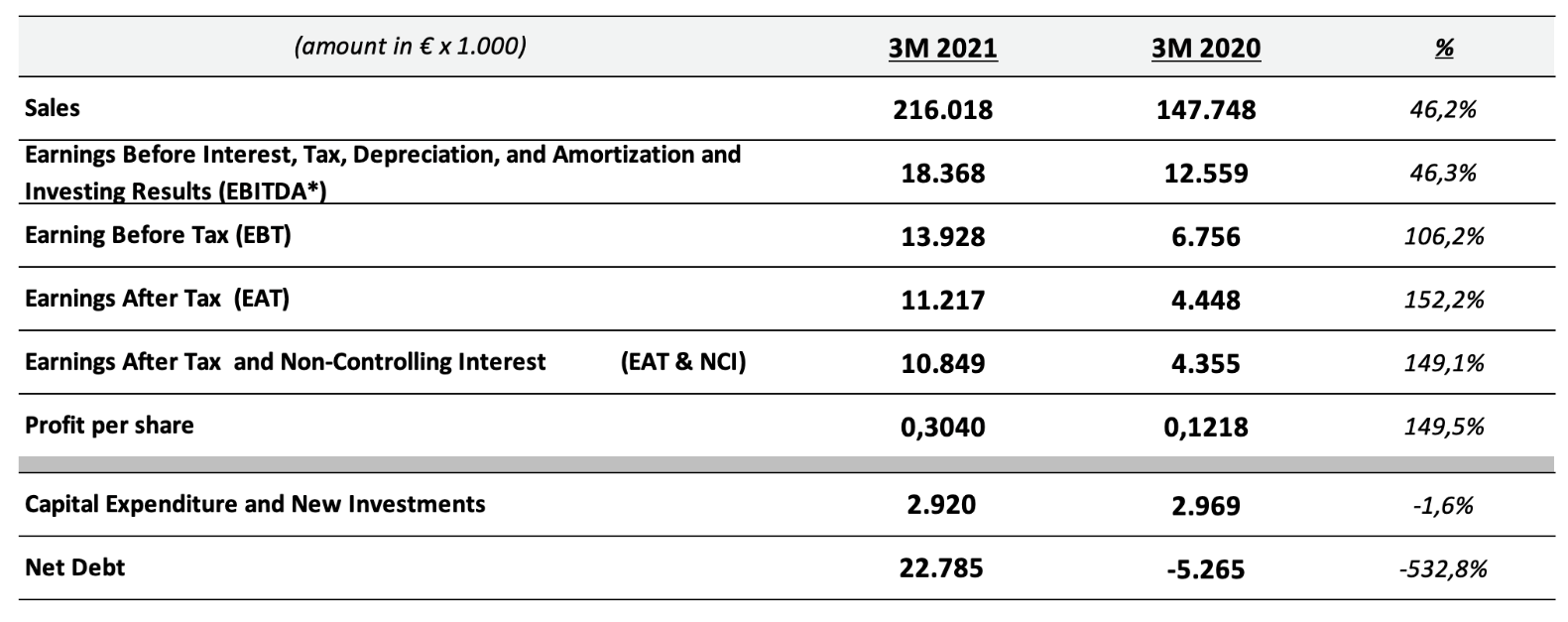

During Q1 of 2021 Quest Group recorded Sales €216m, EBITDA higher than €18m and EBT near €14m, demonstrating:

- Growth in Sales by 46,2%, in EBITDA by 46,3%, in EBT by 106,2% and in EAT by 152,2%.

- At the same time Quest maintained its solid financial status and remained on track with its planned growth investments.

The main consolidated financial results & figures are illustrated as follows:

* Do not include “other gain/losses” related to investment activity.

Group’s Net Debt (Debt minus Cash and Cash Equivalents) was €22,78m, compared to -€10,2m at 31/12/2020. The change from 31/12/2020 is mainly due to elevated working capital needs, which is an annually recurring trend during this period of year. The Group’s investments during Q1 of 2021 were €2,92m. Most of it regards the development of new infrastructure for postal services. EBT and EAT earnings include extraordinary profits of €0,9m from the sale of a minority stake at TEKA Systems SA.

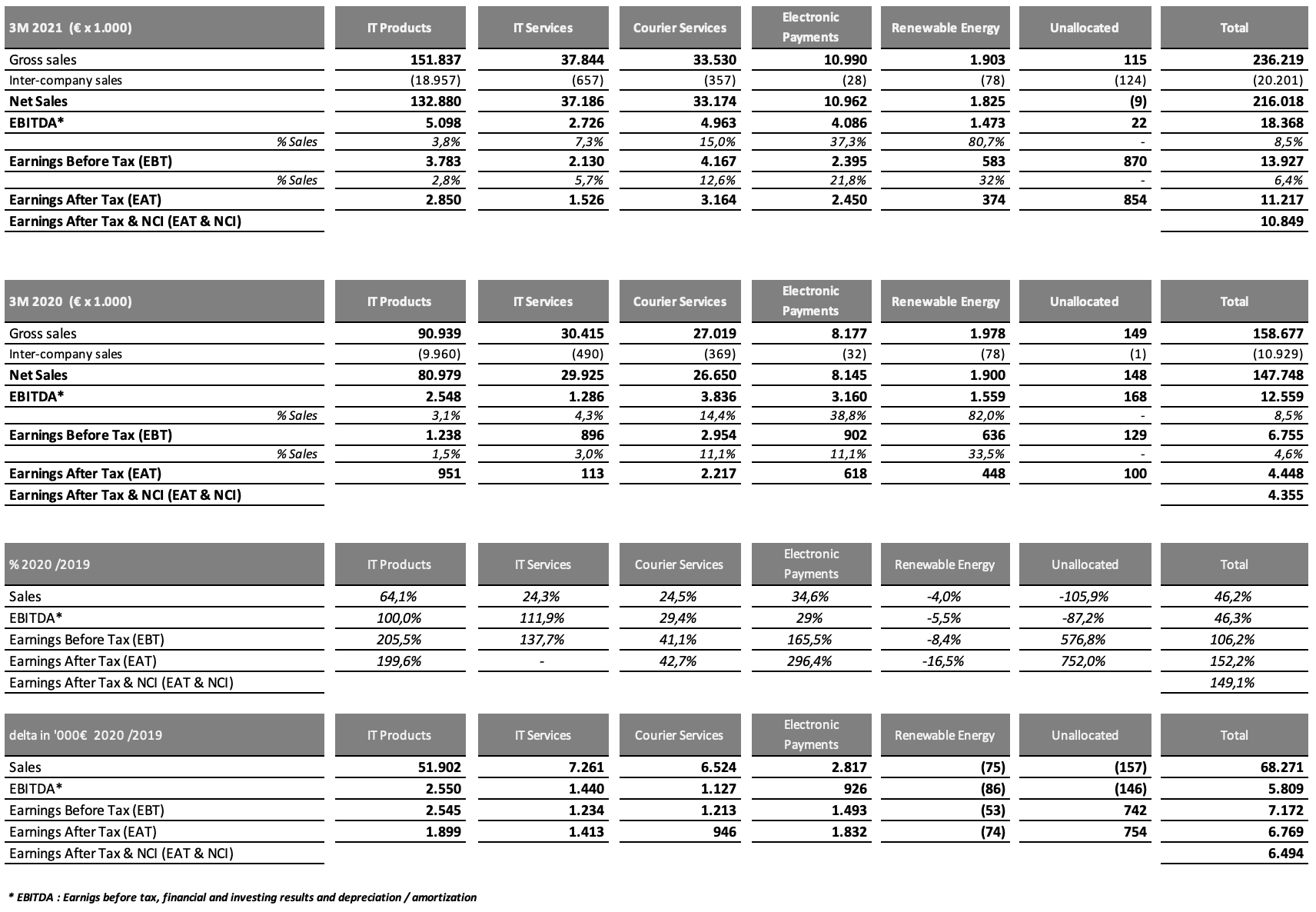

3Μ 2021 Results per segment

- IT Products (companies: Info Quest Technologies, Quest on Line, iSquare, iStorm, Clima Quest).

Sales grew by double digit (+64,1%), followed by tripled EBT (+205,5%) on a YoY basis. In fact, this is the result of the comparison of two different eras, pre and post covid-19, since it is now apparent that the pandemic accelerated the demand in IT products and e-commerce. The improvement in profitability margins is driven by economies of scale due to the steep increase in sales and cost containment.

- IT Services (Uni Systems).

During Q1 2021 sales augmented at a double-digit pace (+24,3%) while EBT over-doubled (+137,7%). Demand for IT services continued to grow, partly because of digital transformation projects of the private and public sector which are accelerated by the pandemic environment. Furthermore, Uni Systems performs more efficiently containing financial and other costs.

- Postal Services (ACS Courier).

During Q1 2021 sales improved (+24,5%), followed by an even higher increase in EBT (+41,1%). ACS gradually streamlines the extraordinary expenses driven by the steep increase in e-commerce volumes and restores profitability at normal levels.

- Electronic Payments (Cardlink).

Sales were highly improved (+34,6%) while ΕΒΤ more than doubled (+159%). The company is not any more burdened by extraordinary expenses (earnout) imposed by the agreement with the customer banks. There’s also a positive effect by the growing penetration of e- payments, which is estimated to be even more noticeable during the coming months, after the opening of the physical retail, the restaurants and the recovery of tourism.

- Renewable Energy Production (Quest Energy).

Sales were marginally lower (-4%) while EBT (-5,5%) on a year over year basis. Main reason was lower sunlight levels compared to the same period last year.

Quest Holdings (parent company).

Parent company 2021 Sales reached €397k compared to €425k and EBT were €851k compared to €76k during same period last year.

During Q1 2021 Quest Holdings partially divested from a minority stake at TEKA Systems S.A. recording a €0,9m capital profit. During April, Quest Holdings sold the remaining stake with similar capital gains, to be included in H1 reports. The aggregate proceeds of the respective transaction are €5m.

2021 Outlook – Estimations regarding the effect of Covid19

Most of the Group’s companies quickly adjusted to the new conditions created by Covid-19 and managed to grow vs 2020.

It seems that many of the Group’s sectors (IT, courier, e-commerce) are positively affected by the consumer trends in the “post Covid-19” era.

In more detail, the following outlook is estimated per segment:

IT Products. The pandemic environment boosts demand for tech equipment and e-commerce who are the segments growth drivers. Our initial estimation for 2021 foresees a high double-digit growth in sales, driven by increase in our market shares, launch of new product categories and e-commerce growth.

IT Services: Uni Systems is positively affected by the high demand in IT services. For 2021 we estimate a double digit growth in sales, driven by high demand for services in Greece and abroad, followed by a similar growth in EBT.

Postal Services: The current estimations for 2021, foresee growth in sales driven by a double digit growth in courier services. The company rolls out its investment plans which for 2021 focus on completing the new sorting hub.

Electronic Payments: After the lift of restrictions, the company is expected to recover to normal operation with an even better outlook due the increasing penetration of its services. For 2021 we estimate growth in sales driven by a further increase in electronic payments and the expansion of the company’s installed base. In parallel we estimate a double-digit growth in profitability, also due to reduced burden, compared to 2020, from the agreement with the Banks.

Renewable Energy Production. There is no disruption in the production and distribution of solar energy, so no negative effect is expected in this sector. For 2021 our initial estimations include a mild growth, driven by the 2020 investments. Further growth may come from further investment in the future.

The Group’s cash position is solid, having near €170m in cash and available credit lines, allowing the non-disruptive continuation of its planned investments.

For the whole year 2021 consolidated Sales, EBITDA and EBT are estimated to be improved compared to FY2020, however at a milder pace than Q1 2021. The improvement of results is also subject to the course of the vaccination program, the opening of the market and the recovery of tourism.

Quest Group’s management will host a conference call to present and discuss Q1 2020 Financial Results, on Thursday 27th of May 2021, at 16:00 Athens time.

- GR participants dial in: + 30 213 009 6000

- UK participants dial in: + 44 203 059 5872

- US Participants dial in: +1 516 447 5632

Group’s Q1 2021 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

Q1 2021 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest corporate website (www.Quest.gr) on Thursday 27th of May 2021.