9Μ OF 2021 FINANCIAL RESULTS

9Μ OF 2021 FINANCIAL RESULTS

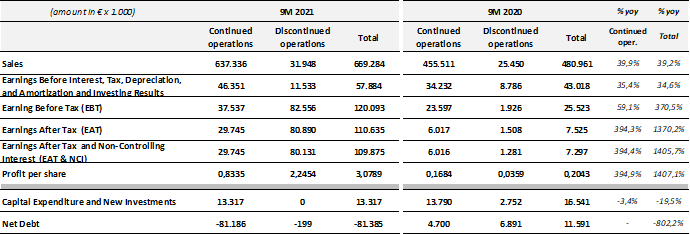

During 9Μ of 2021 Quest Group recorded Sales €669,3m, EBITDA €57,9m and EBT €120,1m, demonstrating:

- Growth in Sales by 39,9%, in EBITDA by 35,4%, in EBT by 59,1% and 5x growth in EAT from continued operations.

- The finalization of the sale procedure of Cardlink S.A. The transaction yields extraordinary capital gains of €85m to the Holdings company and €75,8m to the Group.

The main consolidated financial results & figures are illustrated as follows and are broken down to continued and “discontinued” operations (corresponding to Cardlink S.A. and Cardlink One S.A. and the sale of Cardlink S.A., according to IFRS):

* Do not include “other gain/losses” related to investment activity.

Group’s Net Debt (Debt minus Cash and Cash Equivalents) was -€81,2m, compared to -€10,2m at 31/12/2020, since the proceeds from the sale of Cardlink enhanced the Group’s cashflow. The Group’s investments during 9M of 2021 were €13,3m. Most of it regards to the development of the new central hub of postal services. EBT and EAT include extraordinary profits of €2m mainly from the sale of a minority stake at TEKA Systems SA. At this point it worth noting that 9M2020 EAT were burdened by an extraordinary tax of €11,1m. Exempting the extraordinary tax impact, EAT from continued operations at the 9M2021 are improved by 73,8% compared to last year.

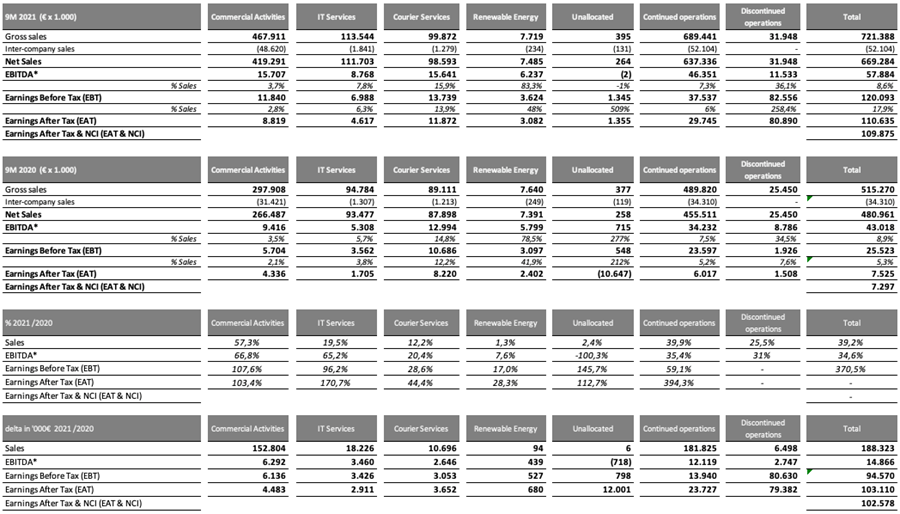

9Μ 2021 Results per segment:

- Commercial Activities -mainly in ΙΤ & Telco products- (companies: Info Quest Technologies, Quest on Line, iSquare, iStorm, Clima Quest).

Sales grew by double digit (+57,3%), followed by a doubled EBT growth (+107,6%) on a YoY basis, since it is now apparent that the pandemic accelerated the demand for IT products and e-commerce. The improvement in profitability margins is driven by economies of scale due to the steep increase in sales and cost containment.

- IT Services (Uni Systems).

During 9M 2021 sales augmented at a double-digit pace (+19,5%) while EBT doubled (+96,2%) with significant improvement in profit margins. Demand for IT services continued to grow, partly because of digital transformation projects of the private and public sectors which accelerated. Furthermore, Uni Systems managed to operate more efficiently and contained its financial and other costs.

On the 1st of October 2021, Uni Systems acquired 60% of Intelli Solutions for an amount of €3,8m. The investment amount may climb up to €5,2m if an earnout projection to previous shareholder is triggered, based on the achievement of specific milestones within the next 2 years.

- Postal Services (ACS Courier).

During 9M 2021 sales improved (+12,2%), followed by an even higher increase in EBT (+28,6%). ACS profitability is also elevated on an YoY basis, due to extraordinary profits generated by the reversal of past years’ provisions. These extraordinary profits amplified EBT by about €1,5m and EAT by about €2m. Recurring profitability is also increased during Q3, but at a slower pace though, as ACS is burdened with increased spending to support the year-end peak demand along with the initiation of operations of the new hub. Once physical retail opened, ACS growth decelerated following the relative e-commerce trends.

- Electronic Payments (Cardlink).- Discontinued activity

Both Sales (+25,5%) and ΕΒΤ were highly improved. After the agreement with Worldline and based on IFRS the activity is considered discontinued and its consolidation will cease as of 1st of October 2021 and onwards.

- Renewable Energy Production (Quest Energy).

During 9M 2021 sales were slightly higher (+1,3%) while EBT also grew by (+17%) compared to last year.

Quest Holdings (parent company).

Parent company 9M 2021 Sales reached €12,7 m compared to €7,6m last year. EBT reached €98,2m compared to €6,3m in 2020. QH income includes dividends of €11,4m compared to €6,3m last year. QH EAT were positively affected by €85,2m from the sale of Cardlink and by €2m from the divestment from minority stakes at TEKA Systems S.A. and Impact S.A..

2021 Outlook – Estimations regarding the effect of Covid19 for the continuing operations

All Group’s companies quickly adjusted to the new conditions created by Covid-19 and managed to grow vs 2020. It seems that many of the Group’s sectors (IT, courier, e-commerce) are positively affected by the consumer trends in the “post Covid-19” era.

In more detail, the following outlook is estimated per segment:

Commercial Activities: The pandemic environment boosts demand for tech equipment and e-commerce, which are the segment’s growth drivers. Our estimation for 2021 foresees a strong double-digit growth in sales and EBT, at a milder pace compared to 9M, mainly due to difficulties in the supply of tech products.

IT Services: This segment is positively affected by the strong demand in IT services. For 2021 we estimate a double-digit growth in sales, driven by high demand for services in Greece and abroad, followed by a similar growth in EBT.

Postal Services: The estimations for 2021, foresee growth in sales driven by a double digit growth in courier services but at a slower pace compared to 9M. During Q4 a slowdown in revenues is expected compared to last year since last year’s physical retail lockdown is not expected to be repeated. The company rolls out its investment plans which are focusing on completing the new sorting hub, which is expected to be ready by the end of 2021 - beginning of 2022. The company is also aiming during the next period to improve the end customer experience.

Renewable Energy Production. There is no disruption in the production and distribution of solar energy, so no negative effect is expected in this sector. For 2021 our initial estimations include a mild growth, driven by the 2020 investments. Further growth may come from further investment in the future.

The Group’s cash position is solid, having above €300m in cash and available credit lines, allowing the non-disruptive continuation of its planned investments as well as the distribution of pre dividend as already announced.

For the whole year 2021 consolidated Sales, EBITDA and EBT are estimated to experience double digit growth compared to FY2020, however at a milder pace than 9M 2021.

Quest Group’s management will host a conference call to present and discuss 9M 2021 Financial Results, on Thursday 25th of November 2021, at 15:30 Athens time.

- GR participants dial in: + 30 213 009 6000

- UK participants dial in: + 44 203 059 5872

- US Participants dial in: +1 516 447 5632

Group’s 9M 2021 Financial Results per Operating Sector:

Parent company is included in Unallocated functions.

9M 2021 Financial Statements of Quest Holdings will be posted on Athens Stock Exchange website (www.helex.gr) and on Quest corporate website (www.Quest.gr) on Thursday 25th of November 2021.